I. The rules of the game

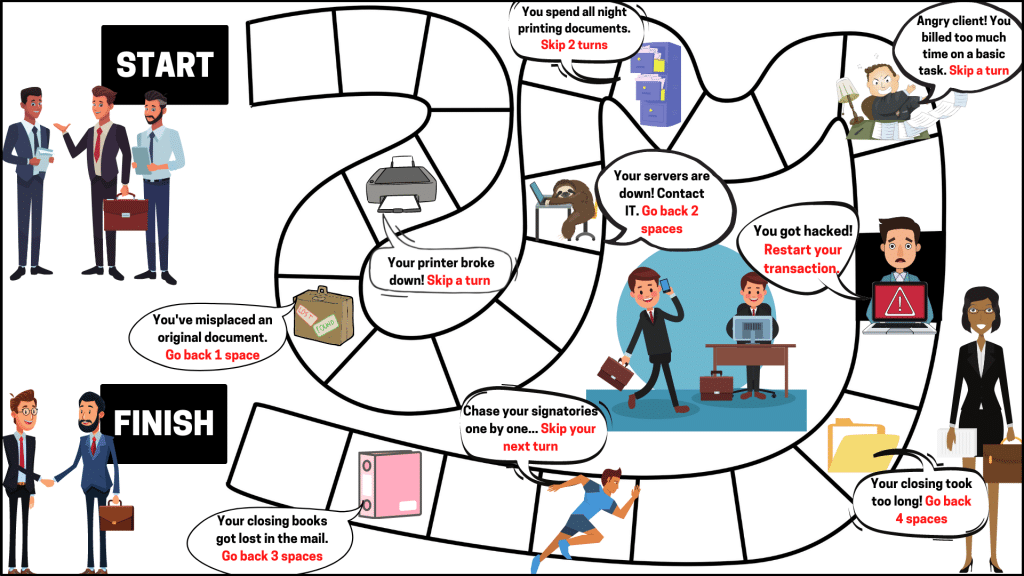

Imagine you’re playing a board game, fashioned as a legal transaction.

You begin at square one, when a client has hired you. You must then follow a winding path through the different stages of the transaction – the due diligence process, drafting, negotiation, signing, closing, and beyond. Other players are competing law firms. The first player to reach the final square closes the deal and wins.

The path is riddled with obstacles. An unlucky roll of the dice can set you back in the game, putting you further from the finish line.

What are these obstacles?

- Legal challenges, on the one hand: complex document review, fraught negotiations, an unrelenting opposing counsel.

- Mainly, though, the path is littered with logistical and procedural obstacles – poor IT infrastructure or communication tools, and a mountain of manual tasks that impede the efficiency, speed, and accuracy of your work.

As a risk-averse legal professional, rolling the dice and risking an unexpected outcome is your worst nightmare, right?

Say you’ve exchanged the wrong version of a document that you now need to spend all night re-editing. Or your printer breaks down as you’re printing hundreds of documents for a closing. Or, worse, you open an innocuous-looking email, only to find your computer is hacked, along with your client’s confidential documents stored on it. Some of these set you back a few steps on the board, while some are disastrous, sending you careening all the way back to square one.

Sound familiar? Chances are, if you’re a transactional lawyer, you’ve already played a version of this game in real life. If during one transaction, you didn’t land on “printer breaking”, then you probably landed on “you need to collect personal contact details from 100+ people to draft contracts.”

Transactions, like the board game, are full of risk. Chances are that you’ll encounter an annoying-at-best and catastrophic-at-worst hurdle along the way that determines how your transaction unfolds. You could lose a client, or harm the reputation of the firm, with immeasurable financial consequences.

II. The Smart Deal card

But what if you could draw a special “smart deal” card that gave you immunity against every obstacle on the board, propelling you unhindered to the end?

In real life, that card would be a digital legal transaction management platform. Legal transaction management tools are software that simplify, accelerate and secure all the steps in a legal transaction. Having such a solution is equivalent to having the superpower to avoid every obstacle on the board. You’re given a significant edge in the game by carrying out every step of your transaction in a digital, collaborative, and safe manner.

Given the chance, would you play the smart deal card, drastically increasing your chances of winning the game? The answer seems obvious.

Yet many lawyers don’t play it. A combination of an insular culture among legal professionals that “eschews change and cherishes tradition” and a a lack of structured change management strategies in firms and legal departments has resulted in fragmented adoption of tech in the legal world. Despite this, transformation is slowly but surely taking hold.

Gartner recently predicted that in-house legal departments will have automated 50% of legal work related to major corporate transactions by 2024, and will increase their spend on technology threefold by 2025. These changes are also happening right now: a recent EY survey found that 92% of firms are already changing the ways they function, with 96% making efforts to automate processes.

These numbers are high for a reason: among others, Gartner found that the average increase in speed for legal departments that automated corporate transactions was 33% – an enormous increase in efficiency. The benefits of having a solution that begets this kind of productivity have been made abundantly clear.

So how does this special card work its magic? Here are a few examples:

Misplaced a contract? Impossible. Documents are centralized on a shared, secured platform (with parties given differing access rights) as a single source of truth, so misunderstandings are largely avoided.

Did not get all conditions precedent from multiple stakeholders on time? Won’t happen. With interactive checklists and automatic reminders, everyone can easily provide and share mandatory documentation.

Signed the wrong version? Unlikely, as counsels can be required to validate the final version of a document before it is electronically signed.

Client is unavailable? Who cares – they can close the deal from thousands of miles away, on their smartphone, and still have a smooth experience.

Your closing books got lost by the courier? They couldn’t have, since they were created and shared with your clients within minutes of the transaction ending, all on the platform.

Original lost? Nope. You chose to archive the transaction’s most sensitive contracts in an ultra-secure electronic safe, in case you need to exhume them for potential future litigation.

Got phished? This may have other consequences (cyberattacks generally don’t have good outcomes), but for the purposes of your transaction, so what? You don’t use email to carry out any part of it, or exchange documents, anyway. The platform on which your really important information is located is so secure that it can’t be hacked. Moving on.

Ta-da! Just like that, the card renders each obstacle harmless. You have free rein over the board.

III. A rising imperative

Even the hurdles that seem inevitable in a complex, high-stakes transaction, like tension with clients, high costs or complex negotiations, can be solved with the smart deal card. For one, by improving the efficiency and quality with which legal services are delivered, you drastically improve client satisfaction. Communication becomes easier, and misunderstandings fewer. And because of the overall efficiency, clarity and simplicity with which information is presented and shared, complex legal tasks in themselves become easier to perform.

Clients themselves have taken note of the fact that their deal experience is much smoother with the aid of a ‘smart deal’ card – they increasingly prioritize the use of technology to these ends among firms they consider hiring. According to Wolters Kluwer, within 3 years 91% of corporate legal departments will ask the firms they are evaluating to describe the technology they use to be more productive and efficient – 52% already do. Smooth interactions, quick completion of deals, and data security brought by legal tech are luxuries clients are accustomed to elsewhere, and they expect no less from their legal services providers.

Among the myriad timesaving, stress-relieving benefits the card brings during deals, then, client satisfaction is a key advantage, boosting a firm’s client base and reputation. Using the card is slowly even becoming a prerequisite for firms to be hired, as its benefits become clear.

Now, would you take your chances not playing the card next round?